SQUIER Retirement Services

[in] Retirement Planning

Building Retirement CERTAINTY In an Uncertain World

Simply put, we help our clients find Retirement Peace of Mind by ensuring our clients cannot outlive their money, have true safety & diversification in their portfolio, dealt with both sides of their retirement healthcare planning, established proper estate plans and reviewed retirement tax considerations.

“Our society has to stop accepting non-answers to their concerns because they sound good. We need real solutions. This is about your future and your money.”

A Hammer to a Screw

Retirement planning is not one size fits all.

Just because they call it “retirement planning” doesn’t mean it is.

It does matter which tools are used for the job!

Your Unique Puzzle!

To achieve Retirement Peace of Mind, all your retirement puzzle pieces should properly fit together.

It is not retirement planning if you are set up on some software-based retirement track from an outdated questionnaire. Each household brings their own unique differences that have to be considered in any planning. Folks get into trouble when their advisors go on auto-pilot.

FIVE Pillars

If asked what retirement planning entails, most will only say finances.

No matter the size of your wealth, these five retirement pillars apply. The success of our retirement is dependent on how much attention we put into each.

We believe it is important to take the necessary time to review each with you to make sure your retirement desires are met.

You must Deal with all your retirement risks Upfront

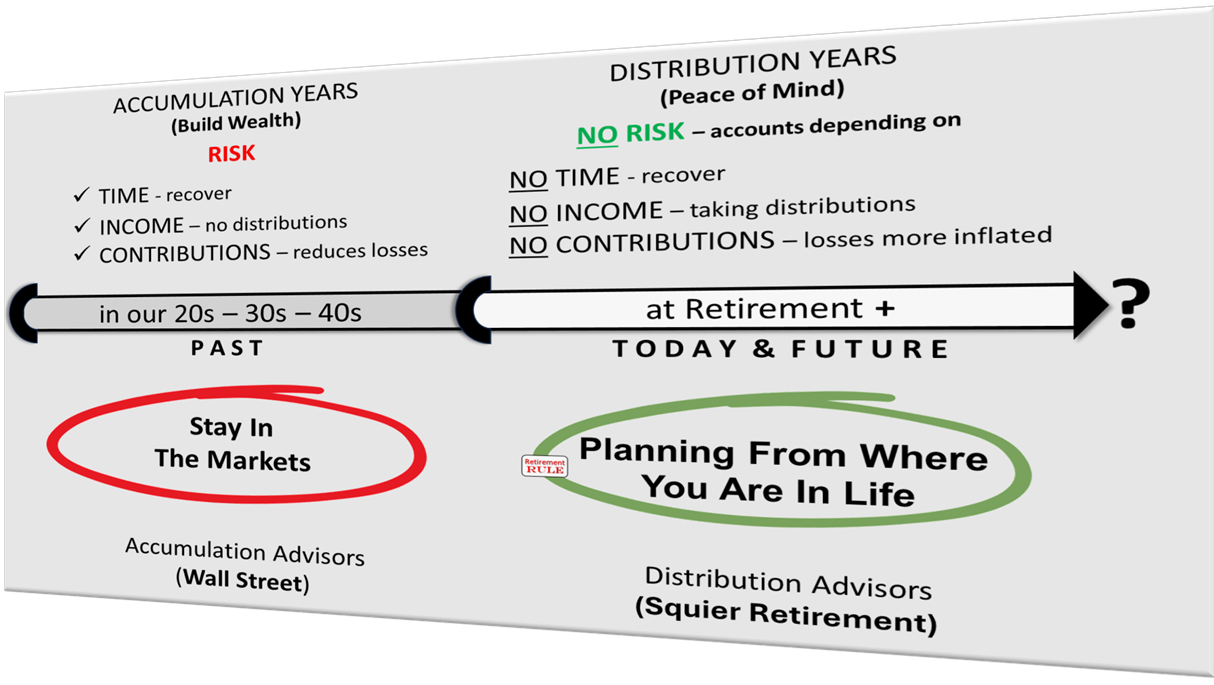

Planning from where you are in life. IS KEY

Sounds simple, yet most don't! Besides age and the sounds we make when getting up, there are stark differences in planning that must be considered.

In our 20 - 30 - 40's we have Time to recover from market losses or bad investments. In retirement, we don't have Time.

In our 20 - 30 - 40's we have a Salary and don't need to take distributions from our accounts. In retirement, we must take distributions, to supplement our income, for large expenses, or IRS Required Distributions.

In our 20 - 30 - 40’s we make Contributions and a possible matching that helps us weather market storms. In retirement, even flat markets cause losses.

Wall Street wants us to believe none of the rules have changed, but unfortunately, all the rules have changed when we retire.

“Does your planning and advice match where you are in life?”

BIG differences

“Planning for Retirement” vs “In Retirement Planning”

Spaghetti Planning

Most are using a retirement "spaghetti planning" approach for their retirements. A little here, a little there, but no planning over there, nothing coordinated, and everything is disjointed. It is like throwing spaghetti at the wall and seeing what sticks.

Like “rebalancing your portfolio” by moving your equity positions around but still having the same risk exposure.

Retirement planning should have a purpose.

Retirement Planning With Purpose

It is common for folks to come to us with many accounts, plans & decisions all moving in opposite directions.

To achieve retirement peace of mind, all your retirement Puzzle Pieces should properly Fit Together.

CASHFLOW is Everything in Retirement

Retirement Income Planning is NOT "projections", "assumptions", or "continue doing what you've been doing since age 40".

You may not run out of money but you probably will live below your means. Why? Because market-based plans are dependent on outcomes you cannot control. So you live a "what if" retirement always concerned about the “what ifs”; inflation, recession, another pandemic, politics, taxes, international issues, etc.

How do you create the most income without running out of money? It starts with understanding your needs, gaps, Social Security, Pension options, account types, etc., and building certainty that provides predictability, meets longevity, and uses the least amount of your assets to get you there.

Your first goal in retirement is to solve your retirement income problem.

Wealth Management

Chances are you have worked hard and made sacrifices to build your accumulated wealth.

If you are like most, you desire not to work backward with market losses but to minimize portfolio losses while building forward with real gains, that are captured.

With better portfolio management we look for ways to strengthen our position in what we can control in retirement; minimize market losses but capture market gains, lessen volatility drag, eliminate the impacts of the sequence of returns, build portfolio efficiency to free up investment capital and reach true portfolio safety & diversification.

There are no do-overs in retirement.

TWO Distinct Sides.

Retirement healthcare planning involves understanding and considering both sides; Medicare and Extended-Care. They require separate coverage needs, so they require separate planning. Both have the ability to devastate a retirement and destitute a spouse.

You must address Both Sides of your retirement healthcare planning.

SIZE Doesn’t Matter

Unfortunately, many feel their estates are too small to consider estate planning. In NJ, if your estate is $20,000 or more, probate may be required.

Estate Planning… is the only way to ensure your voice is heard after you pass away or become incapacitated. It also helps to minimize delays, costs, taxes, and outsider interference all while protecting loved ones & maximizing control for them.

Which PATH are you putting your loved ones on?

Lowering or eliminating retirement taxes

For most, before we retire taxes are more simple as our income comes from one source. When we retire, things get more complicated as we take distributions from multiple types of accounts, managing IRS RMDS tax implications, new transfer tax laws, Medicare IRMAA, Social Security Provisional Income Tax, estate tax, etc.

Understanding your retirement tax considerations helps to remove surprises, make better decisions, avoid penalties, and become more tax-efficient.

our PARTNERS

There are a lot of diverse areas to be managed. And we will never pretend to know everything. Here's what we know: the importance of having good resources for our clients that can help complement what we are doing.

Helping pre-retirees & retirees in the Preservation & Distribution phase of their lives through education, guidance & solutions that can provide Guarantees.